child tax credit 2021 payment dates

For 2021 only the child tax credit amount was increased from 2000. Here are the official dates.

Enter your information on Schedule 8812 Form.

. To reconcile advance payments on your 2021 return. How Next Years Credit Could Be Different. 2020 and 2021 CTC before ARPA stimulus bill increase The Child Tax Credit CTC was set to 2000 per child for 2021 before Biden Stimulus bill ARPA.

The IRS has made a one-time payment of 500 for dependents age 18 or full-time college students up through. Advance Payment Process of the Child Tax Credit. These updated FAQs were released to the public in Fact Sheet 2022-29PDF May 20 2022.

IR-2021-153 July 15 2021. After only one monthly payment after the policy passed in March 2021 the expanded credits cut child poverty by 25 percent according to Vox. The schedule of payments moving forward will be as follows.

The American Rescue Plan Act ARPA of 2021 expands the Child Tax Credit CTC for tax year 2021 only. NOEC and Ontario sales tax credit OSTC All payment dates. By August 2 for the August.

To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. CHILD TAX CREDITS CUT CHILD POVERTY. Each payment will be up to 300 for each qualifying child under the age of 6 and.

Get your advance payments total and number of qualifying children in your online account. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. 13 opt out by Aug.

Child Tax Credit 2021. 3 January - England and Northern Ireland only. The Child Tax Credit payments are being sent out to eligible families who have filed either a 2019 or 2020 tax return.

Even if you had 0 in income you could have received advance Child Tax Credit payments if you were. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The payments are one of multiple changes to this years child tax credit thanks to legislation in the American Rescue Plan.

The payments will be made either by direct deposit or by paper. Below are frequently asked questions about the Advance Child Tax Credit Payments in 2021 separated by topic. The payments will be paid via direct deposit or check.

21 rows 28 December - England and Scotland only. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes. IR-2021-169 August 13 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of August as direct deposits begin posting in bank accounts and checks arrive in mailboxes.

If your payment is late check the. Department of the Treasury. Payments roll out starting July 15 heres when the money will land 0532.

Frequently asked questions about the 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic E. List of payment dates for Canada Child Tax Benefit CCTB GSTHST credit Universal Child Care Benefit UCCB and Working Income Tax Benefit WITB. Disbursement of advance Child Tax Credit payments began in July and continued on a monthly basis through December 2021 generally based on the information contained in your 2019 or 2020 federal income tax return.

The advanced payments will be up to 50 percent of the total estimated credit which is based on information included in eligible taxpayers 2020 tax returns or their 2019 returns if the 2020 returns are not filed and. 7152021 125213 PM. The child tax credit is usually worth 2000 per qualifying child but for 2021 its been expanded to 3600 for kids ages 5 and under and 3000 for kids between 6 and 17.

15 opt out by Oct. It doesnt matter if they were born on January 1 at 1201 am. The IRS says the monthly payments will be.

15 opt out by. In 2021 then you will receive the child tax credit so long as your income is below 440000 if youre married and filing jointly. This first batch of advance monthly payments worth.

15 opt out by Aug. Much has been said about how the child tax credits have cut child poverty in the last few months. Or December 31 at 1159 pm if your child was born in the US.

Updated May 20 2022 A3. Did I need income to receive advance Child Tax Credit payments. Eligible taxpayers who dont want to receive advance payment of the 2021 Child Tax Credit will have the opportunity to unenroll from receiving the payments.

The IRS said. Eligibility for Advance Child Tax Credit Payments and the 2021 Child Tax Credit and Topic E. Publication 5534-A 6-2021 Catalog Number 38433P.

Child Tax Credit 2022. Advanced payments of the 2021 CTC will be made monthly from July through December to eligible taxpayers starting July 15. Half of the total is being paid as six monthly payments and half as a 2021 tax credit.

August 10 2022. Payment Month Payment Date. The only caveat to this is if you and your childs other parent dont live.

Child Tax Credit Will There Be Another Check In April 2022 Marca

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

The Final Child Tax Credit Payment Of 2021 Is Here Is It The Last One Ever Here S What Happens Next Marketwatch

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

The Gst Bill Was Recently Approved By The Lok Sabha On March 30th And Will Directly Affect Everyone In The Coun Filing Taxes Indirect Tax Goods And Service Tax

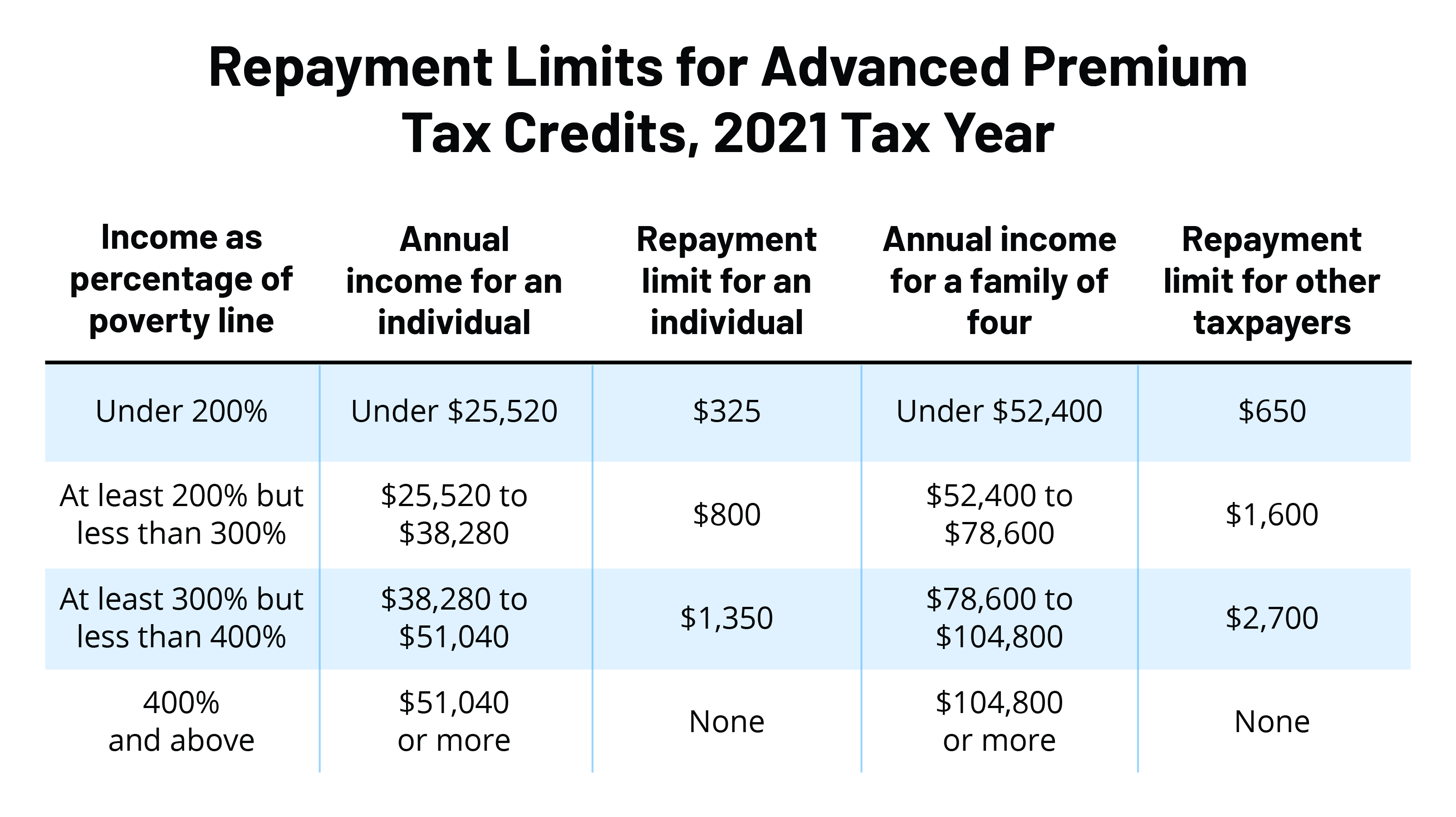

What S The Most I Would Have To Repay The Irs Kff

Safeguarding Tax Credit Of Every Tax Form 26as Tax2win Online Taxes Filing Taxes Income Tax

Claim Your 30 Solar Investment Tax Credit Itc Solar Electric Contractor In Seattle Wa 206 557 4215 Solar Tax Credits Solar Energy Projects

How Long Does It Take To Get Tax Returns Tax Return Tax Refund Irs Taxes

The Child Tax Credit Toolkit The White House

Pin By Tax Consultancy On Tax Consultant Tax Deductions Bank Statement 1st Bank

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

The Child Tax Credit Toolkit The White House

The Child Tax Credit Toolkit The White House

Early Child Tax Credit Payments How They Impact Your Taxes Cnet In 2022 Child Tax Credit Tax Credits Tax

Psa Didn T Get A Stimulus Payment You Might Need To Do This In 2021 Child Tax Credit Tax Debt Irs